See the State Proceeds and Allowances table for a summary of Auction [[ auction_number ]] proceeds by state.

RGGI Auction [[ auction_number ]] was held on [[ auction_date ]] and monitored by Potomac Economics, an independent monitor of electricity markets retained to evaluate the RGGI CO2 allowance market. Potomac observed the auction and found no material evidence of collusion or manipulation by bidders.

Below are key data and information on the results of the auction. Detailed analysis is available in the Market Monitor Report for Auction [[ auction_number ]].

Auction Statistics

- Offering: [[ quantity_offered ]]

- 2019 CCR Allowances Available: [[ ccr_available ]]

- CCR Allowances Sold: [[ ccr_sold ]]

- Quantity Sold: [[ quantity_sold ]]

- Clearing Price: $[[ clearing_price ]]

- Number of Bidders: [[ actual_bidders ]]

- Ratio of Bids to Initial Supply: [[ ratio ]]

- Percent Won by Compliance Entities: [[ percent_won_by_compliance ]]%

- Percent Won by Compliance-Oriented Entities: [[ percent_won_compliance_ori ]]%

Auction Participation

A total of [[ potential_bidders ]] potential bidders submitted an Intent to Bid in the auction. For a list of potential bidders by name, see the Market Monitor Report.

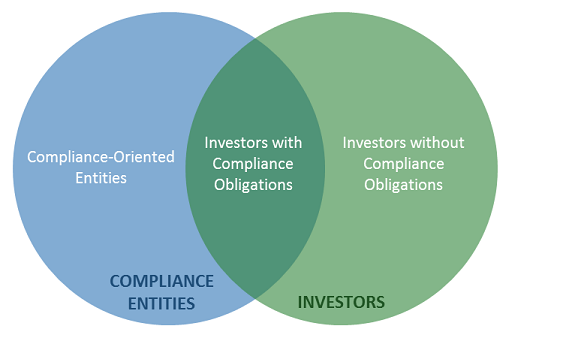

For reporting purposes, firms are often broken up into the following distinct categories.

- Compliance-Oriented Entities: Compliance entities that appear to acquire and hold allowances primarily to satisfy their compliance obligations.

- Investors with Compliance Obligations: Firms that have compliance obligations but which hold a number of allowances that exceeds their estimated compliance obligations by a margin suggesting they also buy for re-sale or some other investment purpose. These firms often transfer significant quantities of allowances to unaffiliated firms.

- Investors without Compliance Obligations: Firms without any compliance obligations.

These three categories form the basis for two overlapping groups.

- Compliance Entities: All firms with compliance obligations and their affiliates. Combines the first and second of the above categories.

- Investors: All firms which are assessed to be purchasing for investment rather than compliance purposes. Combines the second and third of the above categories.

In Auction [[ auction_number ]], Compliance-Oriented Entities purchased [[ percent_won_compliance_ori ]]% of the allowances sold.

In Auction [[ auction_number ]], Compliance Entities purchased [[ percent_won_by_compliance ]]% of the allowances sold.

In the first [[ auction_number ]] RGGI auctions, compliance entities and their affiliates purchased [[ cumulative_won_by_complian ]]% of the allowances sold.

[[ holdings_by_compliance_ori ]]% of allowances in circulation will be held by Compliance-Oriented Entities following the settlement of allowances sold in Auction [[ auction_number ]].

[[ holdings_for_compliance_pu ]]% of allowances in circulation will be held for compliance purposes following the settlement of allowances solid in Auction [[ auction_number ]]. The number of allowances that are believed to be held for compliance purposes is the allowances held by Compliance-Oriented Entities and a portion of allowances held by Investors with Compliance Obligations.

Dispersion of Bids

Bids were submitted by [[ compliance_oriented_bidder ]] Compliance-Oriented Entities and [[ other_bidders ]] Investors.

[[ compliance_oriented_large_ ]] Compliance-Oriented Entity and [[ other_large_bidders ]] Investors submitted bids for a large quantity of allowances (i.e., at least 1 million tons).

Overall, Compliance-Oriented Entities accounted for [[ percent_bids_compliance ]]% of the quantity of allowances for which bids were submitted. The quantity of allowances for which bids were submitted was [[ ratio ]] times the initial offering of [[ quantity_offered ]] allowances.